Introduction

Every business is an information business and for that matter an insurance broker software forms an integral part within insurance broking value chain. Inbound and outbound transactions, client data and customer service are all managed through this software.

M-Broker Software is a modern set of tools for managing the day-to-day business processes. It provides a centralized place for information to be categorized and stored for easy retrieval. It also streamlines operations by helping brokers automate tasks like quoting, underwriting, billing, claim management and more leading to reduction of waste and improve turnaround time.

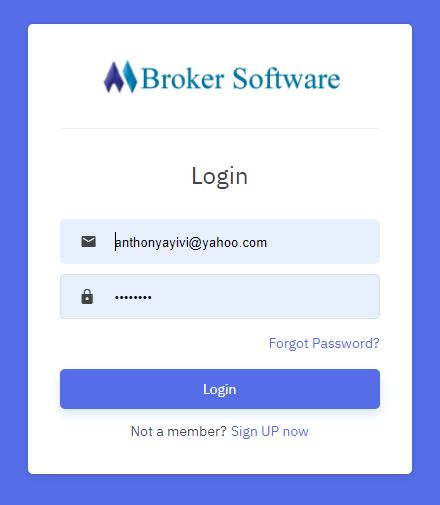

The M-Broker Software

M-Broker Software is an innovative Insurance Broking Management System that was specifically designed for the independent insurance broker. It is a complete management system designed to handle all aspects of running insurance broking from tracking policy renewals to working on expiration list and everything in between.

M-Broker Versions:

- M-Broker Software (Standard Edition) as a client-server-based desktop application and

- M-Broker Software (Online) as cloud-based application (Software-as-a-service).

The software offers many distinguishing features for insurance brokers, and consultants backed by comprehensive reporting and analysis that provides accurate information for effective decision making leading to increase in efficiency and visibility into operational activities.

M-Broker allows users unlimited access to a client’s profile with just a click of a button. There are eight main modules;

M-Broker allows users unlimited access to a client’s profile with just a click of a button. There are eight main modules;

- Dashboard (workflow automation, widgets)

- Setups/Utilities Maintenance: (setting up initial parameters etc)

- Client Maintenance: (Client details, contacts, referrals, industry etc)

- Policy Maintenance: (Policy information)

- Debit/Credit Processing: (Debits notes, credit notes, payments, outstanding)

- Claims Maintenance: (Register a claim and its status)

- Marketing Modules:(Schedules, Meetings and Tasks)

- Reports: (All forms for decision making and ensuring higher visibilities into operations

- Accounts (Revenue and Expenses, Customers, Suppliers,Payables , Receivables, Ledgers) yet to be integrated'

- Integration (Customer portal, Third Parties/API, Service Portal) available on cloud version

More Info

- Create & Manage clients – Add your client’s information and retrieve them when needed. . It easily helps the end user to look up for a client and the class/number of policies in the account name.

- Create & Manage policies – Simply create policies and link it to clients at a click of a button. All Risk items, Claims , debit notes and payments, documents in one place

- Create & Manage End Users and Agent - Every agency needs some agents to help out and covers this as well. You can create accounts for your end users members and they will have access to run and manage the daily operations. renewals , meetings and schedules etc

- Record payments – Every payment is easily recorded in the system, confirmed and commission received against..

- Upload Documents – Either receipts, policy wording, fleets, cheques , ids etc, you can simply upload them under documents section of a client or policy.

- Reports - On demand reports are available anytime you need them. Being production, renewals, NIC reports format , Commission generated, Commissions outstanding .

- Bulk SMS & Email - Communication module allows agencies to send single and bulk messages to policy holders and many more

.

Share On Social Media

Third-party insurance premiums up from January 1; ¢482 for private cars and ¢637 for taxis

Read MoreWhy Buy Insurance ?

There will be no need for insurance if we are living in a perfect world on this planet called EARTH. Our goods would always arrive at their destination

Read MoreEmerging Trends In Ghanaian Insurance Market An Overview

According to a report by a UK based IT Solutions, Ghana has one of the fastest growing insurance industries in the world.

Read MoreTop 10 Insurance Brokers In Ghana

Ghana 2016 68 Insurance brokering companies that operated in Ghana in 2016 earned Income of GHC 73,144,221 in 2016 representing growth rate of 12%.

Read More