Importance of insurance for Ghana’s informal sector traders

The devastation at Kantamanto by fire on the morning of 3rd January 2025 is not only a stark reminder of the vulnerability of informal sector traders but also highlights a critical issue—many of these traders have no insurance to cushion their losses.

In an economy where informal businesses make up a significant portion of employment, the lack of insurance coverage for traders like those in Kantamanto is a glaring issue that demands attention.

The devastation at Kantamanto is not only a stark reminder of the vulnerability of informal sector traders but also highlights a critical issue—many of these traders have no insurance to cushion their losses.

As of 2025, only a fraction of Ghana’s informal sector workers, including the majority of traders in markets like Kantamanto, have access to formal insurance schemes. The reasons for this are multifaceted and rooted in a combination of economic, cultural, and infrastructural factors.

Without insurance, these traders are left to bear the full financial brunt of events like fires, theft, and accidents, which can wipe out their entire livelihood.

A Hidden Struggle: The Informal Sector's Insurance Crisis

In Ghana, the informal sector employs over 80% of the working population, according to the Ghana Statistical Service. However, the vast majority of these workers—small business owners, vendors, artisans are not insured.

A UNDP report reveals that despite Ghana's favorable environment for insurance, about 70% of Ghanaians do not have access to any form of insurance.

For the traders at Kantamanto, the fire is a catastrophic loss, and there is little recourse to recover their assets.

“I never thought I would need insurance until today,” said Kwasi Ampah, his voice heavy with frustration. “Now, I have nothing. I’ve worked for years to build this business, and just like that, it’s all gone. If I had insurance, I would have at least had some support, but now, I’m left with nothing.”

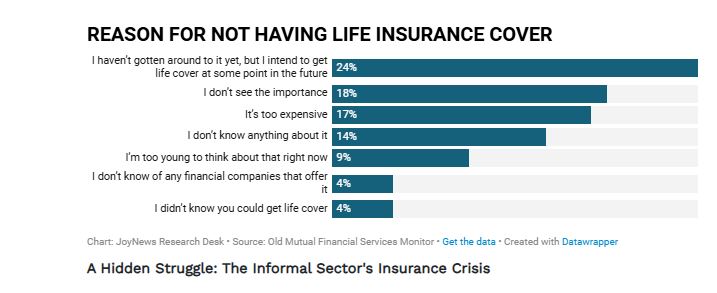

The lack of insurance for informal sector workers is a pervasive problem in Ghana. Informal traders often find insurance premiums too costly, with many insurers targeting larger, formal businesses instead. The lack of awareness and education about the importance of insurance, compounded by a lack of trust in insurance companies, further deepens the gap. Many informal workers are also skeptical about the benefits of insurance, feeling that the costs outweigh the potential benefits, especially given the instability of their incomes.

“Insurance is a luxury, not a necessity for us,” says Abena Amankwah, a trader whose stall was completely destroyed in the fire. “The premiums are too high, and we don’t see the value of paying into something we might never need. Now that it’s happened, I see the need, but it’s too late.”

Ghana's Challenges with Informal Sector Insurance

While there are formal insurance providers in Ghana, these policies are often inaccessible to informal sector workers. The reasons for this are deep-rooted in the country’s socio-economic structure. First, there is a general lack of understanding of insurance products among informal sector workers, with limited education or outreach to rural communities and urban markets like Kantamanto.

Moreover, informal workers typically do not have regular, stable income streams that meet the underwriting requirements of traditional insurance companies. Many insurance schemes are tailored to salaried workers or those in formal employment, with structures that don’t accommodate the irregular, cash-based nature of informal work. In addition, the high premiums and stringent requirements make it difficult for traders who often live paycheck to paycheck to afford insurance coverage.

Some companies have tried to develop micro-insurance products tailored for informal sector workers, offering lower premiums and flexible payment terms. However, these products have had limited success, as a combination of low awareness, skepticism, and logistical challenges in reaching informal workers has hindered their widespread adoption.

What are Insurance Companies doing?

Insurance companies in Ghana are actively responding to the challenge of low coverage in the informal economy by developing micro-insurance products, leveraging mobile technology, partnering with the government and NGOs, offering flexible payment options, and simplifying claims processes. However, there are still barriers to widespread adoption, such as limited financial literacy and mistrust in insurance, which companies continue to address through targeted outreach and education efforts. By continuing to innovate and work closely with informal sector workers, Ghanaian insurance companies are gradually improving insurance coverage in this critical segment of the economy.

Ghana can learn several valuable lessons from countries that have successfully extended insurance coverage to informal sector workers. By studying international best practices, Ghana can adapt and implement strategies that suit its own context and improve insurance access for informal sector workers.

Ghana can learn a great deal from countries like Kenya, India, South Africa, and Mexico, which have successfully expanded insurance coverage to informal sector workers. Key takeaways include:

- Developing affordable, tailored micro-insurance products.

- Leveraging mobile technology to make insurance more accessible.

- Encouraging public-private partnerships to improve outreach and affordability.

- Simplifying claims processes to ensure ease of access.

- Offering subsidized premiums for low-income groups.

- Investing in education and awareness campaigns to increase engagement with insurance programs.

By combining these strategies and adapting them to its own context, Ghana can improve insurance coverage for informal sector workers and reduce the barriers that prevent them from accessing financial protection.

Dilemma for Insurers

As the frequency and scale of these fires increase, insurers are facing mounting pressure on how to adequately fund and support the victims of these catastrophic events, even if they were insured.

“Insurance is based on principles of uncertainties. Market fires have become rampant because they have become certainties. We can alternatively create a pool to support victims but how do we fund such a system?, Seth Aklasi, President of the Ghana Insurers Association said.

Industry experts have called for a reassessment of the insurance models currently in place, advocating for more comprehensive coverage that considers the unique needs of Ghanaian businesses. Additionally, fire prevention measures, better risk management practices, and public awareness campaigns could help mitigate the impact of these devastating fires.

As the situation continues to evolve, insurers must find innovative solutions to help victims recover while also ensuring their own financial sustainability in an increasingly volatile environment. Without quick action, the ripple effects of these frequent market fires could pose long-term challenges to both businesses and the insurance sector alike.

The Need for a Change in Policy

For Ghana’s informal sector to thrive and recover from calamities like the Kantamanto fire, policymakers must urgently address the issue of insurance accessibility. The government has a role to play in encouraging the growth of micro-insurance markets that are better suited to the needs of informal sector workers.

One of the key ways the government and private sector are addressing low insurance coverage is through the development of micro-insurance products. These are designed to be affordable, flexible, and accessible to low-income individuals, including those in the informal sector.

One potential solution could be public-private partnerships to develop affordable, accessible insurance products. These could include policies that are tailored to the cash flow realities of informal traders, with the government offering subsidies or support to make premiums more affordable.

Another option is increasing financial literacy programs that focus on the importance of insurance and how it can protect traders from unexpected losses. More proactive outreach by insurers, including agents who can engage with traders directly in the market, would go a long way toward building trust and awareness.

Hope for the Future: The Path to Resilience

As the traders of Kantamanto and their families grapple with the aftermath of the fire, the absence of insurance looms large over their futures. For many, their dreams of rebuilding are now on hold, with no financial backup to help them recover.

However, there is hope that this disaster could spur change. If the government, insurers, and financial institutions collaborate to create more inclusive and accessible insurance products, the informal sector could become more resilient in the face of future crises. Traders like Georgina Nartey and Kwasi Ampah believe that change is possible—but it requires a collective effort from all sectors of society.

“We need to come together to support each other, but we also need systems that can help us bounce back when things go wrong,” said Georgina. “Insurance should not be something for only the rich or those in formal jobs. We all need protection.”

The fire at Kantamanto has exposed a significant vulnerability in Ghana’s informal economy, but it also presents an opportunity to rethink how insurance can be made more inclusive. With the right policies and infrastructure, the country can help protect its informal sector workers, ensuring they are better equipped to face the challenges of tomorrow.

Efforts to Rebuild

As the cleanup process continues, many traders are banding together, showing resilience in the face of adversity. There are plans for a collective effort to rebuild the market, though it will likely take months, if not longer, to return to normalcy.

While the government’s aid trickles in slowly, some traders have started receiving assistance from local NGOs and philanthropic organizations. These groups have pledged to provide temporary relief, offering food, water, and small grants to help those most affected.

“We cannot give up,” said Kwasi Ampah, wiping tears from his eyes. "We have to rebuild. Kantamanto is more than just a market; it’s a community. And we are determined to stand together and rise from this."

Source : Daryl Kwawu - myjoyonline.com

Disclaimer: "The views expressed on this site are those of the contributors or columnists, and do not necessarily reflect insureghana's position. insureghana.com will not be responsible or liable for any inaccurate or incorrect statements in the contributions or columns here."

Share On Social Media

Other Posts

Edward Mensah, Wood and Associates Insurance Brokers Named Overall Best Insurance Broker 2024

CSA has sounded the alarm about insider threats in the insurance sector

Ghana’s insurance industry intensifies public education to build trust and boost coverage

Impact Life Insurance Company Limited launches “ABRABOPA” product in Kumasi

Insurance companies in Ghana: ranking per 2024 insurance revenue

Ghana’s 24Hour programme: Who’s leading, how it’s measured, and when it starts

Five (5) Reasons Why You Need a Homeowners Insurance Policy

Bringing insurance education to classrooms in Ghana

Finance Minister charges new NIC board to expand insurance coverage

Imperial General Assurance donates cash to support Radiology Department of Korle Bu

InsureTech

Technology