Government To Sanitise The Insurance Industry, Yaw Osafo Marfo

23 March, 2019

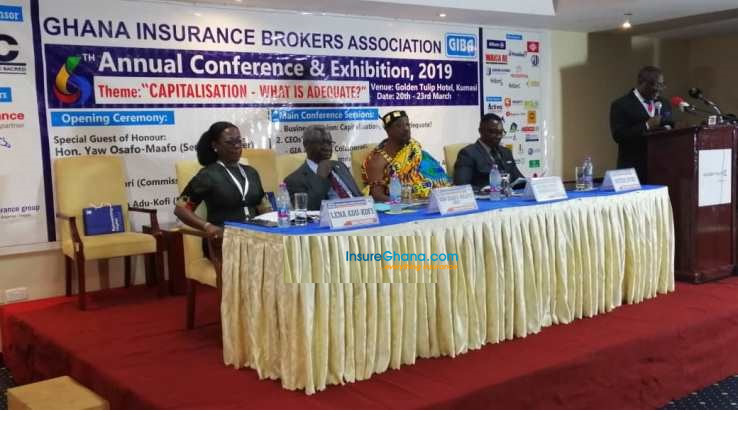

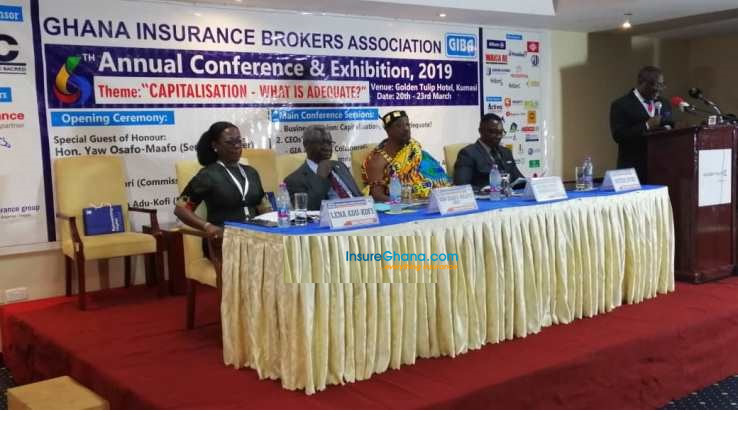

The Senior Minister, Yaw Osafo Marfo, says government will soon sanitize the insurance industry in Ghana at just ended GIBA Conference in Kumasi

Speaking at the annual conference of the Ghana Insurance Brokers Association in Kumasi, Mr Osafo Marfo urged insurance companies to consider merging as a way of increasing their financial muscle to better serve their clients.

“As government we are taking tough decisions to sanitize the banking sector. We will soon sanitize the insurance sector also because the two move together.

”President of the Ghana Insurance Brokers Association (GIBA), Lena Adu-Kofi, tasked members to address their capital inadequacies to avoid unfavourable outcomes.She appealed to regulators to assist the market with policy framework that will optimize potentials in the insurance market.

“Having embraced the need to increase the Minimum Capital Requirement, we as market players should be looking at the way forward.“This is because, adequate capital can serve as a solid foundation to induce growth in our companies and our industry at large.

”Commissioner of Insurance Justice Yaw Ofori explained the need for an upward adjustment of the minimum capital requirements of insurance companies.“An upward revision of Minimum Capital Requirement (MCR) is expected to help improve effectiveness and increase underwriting and retention capacity of our market.

“Increasing the MCR is only one of a number of steps needed to strengthen the insurance industry. Other steps include enforcing current compulsory insurances to improve penetration, implementing risk-based supervision and solvency requirements, and improving the claims payment to improve public trust in insurance.

”GIBA is in support of the proposed Minimum Capital Requirements of GH¢500,000.The Association is however entreating those who cannot meet the recapitalization to consider mergers.

By Ibrahim Abubakar|3news.com|Ghana

Disclaimer: "The views expressed on this site are those of the contributors or columnists, and do not necessarily reflect insureghana's position.

insureghana.com will not be responsible or liable for any inaccurate or incorrect statements in the contributions or columns here."

Other Posts

What is Cyber-Insurance? What You Need To Know

15 Best AI Tools Every Insurance Agent Should Use | AI for Insurance Agents

Edward Mensah, Wood and Associates Insurance Brokers Named Overall Best Insurance Broker 2024

CSA has sounded the alarm about insider threats in the insurance sector

Ghana’s insurance industry intensifies public education to build trust and boost coverage

Impact Life Insurance Company Limited launches “ABRABOPA” product in Kumasi

Insurance companies in Ghana: ranking per 2024 insurance revenue

Ghana’s 24Hour programme: Who’s leading, how it’s measured, and when it starts

Five (5) Reasons Why You Need a Homeowners Insurance Policy

Bringing insurance education to classrooms in Ghana

Business intelligence: the driving force behind insurance sector evolution

Read More

Revolutionising auto insurance: How AI can transform vehicle damage assessment

Read More

Insurance Commission advances digital transformation agenda

Read More

Emerging Trends In Ghanaian Insurance Market An Overview

Read More

What Your Insurance Broker Should Do For You

Read More

7 Signs Of Unethical Insurance Broker

Read More