Ghana’s Non-life Insurance Figures: 2018 In Perspective

In a country that can feel increasingly troubled and uncertain, a robust and trusted insurance sector provides valuable bedrock of security. Insurance business is one of the developed businesses in Ghana. Even though the penetration is low, the industry continues to generate significant profit year after year.

The sector plays a very important role in the economy, allowing individuals and firms to transfer risk for a premium. A healthy and well-developed insurance industry will improve the stability of financial markets as well.

The Insurance Act, 2006, Act 724 section 80 and 81 mandates insurance companies to prepare and lodge their accounts and financial statement with the National Insurance Commission every quarter and every financial year. This article considers the unaudited data on Ghana’s non-life insurance industry in terms of gross premiums generation, market share, claims paid and investment, putting 2018 in perspective. The article also sets out the size and strength of Ghana’s insurance industry and demonstrates its dual role as a provider of protection and as a long-term stable investor underpinning the economy.

Gross Premium

The four main business lines of the Property & Casualty (P&C) insurance market are motor, property, general liability and accident. Economic conditions tend to strongly affect the performance of the P&C sector, since higher levels of economic activity create greater demand for protection products. The P&C sector is also cyclical. When the price of risk is high, new capital is attracted into the market, but the increased competition that results then pushes prices down even though the National Insurance Commission is trying hard to eliminate that.

The total gross premium generated at the end of 2018 was Ghc1,271,798,928. With this amount, Enterprise insurance generated gross premium of Ghc184,281,404, followed by SIC insurance (177,995,301), Star Assurance (122,811,363), Vanguard Assurance (104,303,128) and Hollard insurance (96,819,681). The remaining 22 insurers generated Ghc585,588,051 with Loyalty insurance having the lowest gross premium generation of Ghc4,692,506.

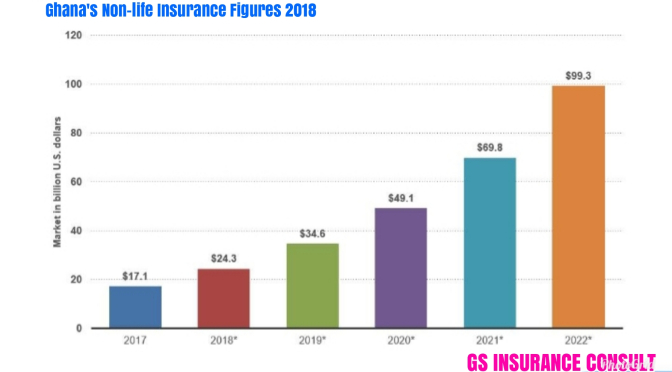

So there have been significant increase in the total gross premium generation by the insurance companies combined in Ghana.

Investment

Investments are a key component of the insurance business model, in which premiums paid to insurers are invested until liabilities fall due. The insurance industry is one of the largest institutional investor in Ghana, making it an important provider of the investment needed for economic growth. Since most of their assets back long-term liabilities, insurers tend to invest long-term.

Growth in the investment portfolio of some insurance companies was outstanding in 2018. The total investment portfolio managed by the non-life insurance companies grew at the end of 2018 by Ghc1,386,691,397. Out of that figure, Star Assurance had an outstanding investment portfolio of Ghc291,385,066, followed by SIC insurance (208,206,636), Enterprise Insurance (132,369,398), Hollard insurance (79,876,156) and Ghana Union Assurance (66,791,870). The investment portfolio by the remaining 22 insurers was Ghc608,062,270 with GN insurance having the lowest investment portfolio of Ghc6,100,822.

Market Share

For the first time in so many years, Enterprise Insurance Co. Ltd became the market leader in 2018 in Ghana’s insurance industry after many years of striving to be at the number one position. The company was able to overtake SIC insurance Co. Ltd. Results at the end of 2018 indicated that the company had a market share of 14.5% in the general insurance market, and SIC insurance had 14%.

See Also: Patience Akyianu appointed Group CEO of Hollard Ghana Holdings

By the end of 2017, SIC insurance was leading the market by 13.8%, followed by Enterprise Insurance with 13.56%, Star Assurance – 10.9%, Vanguard -8.36%, Hollard Insurance– 7.53%, and the other insurers followed.

The market share ladder at the end of 2018 was followed by Star Assurance Co Ltd – 9.7%, Vanguard Assurance Company Limited – 8.2%, Hollard Insurance Ghana Limited – 7.6%, Glico General Insurance Company Limited – 5.9%, Activa International Insurance Company Limited – 5.2%, Phoenix Insurance Company Limited – 3.9%, Ghana Union Assurance Company Limited – 3.4%, Equity Assurance Company Limited – 3.2%. The remaining 17 general insurance companies accounted for 24.5% of the industry market share. The insurers with the least share are GN insurance and Multi insurance, all having 2% each.

Claims Expenses

The most sensitive area in insurance where Ghanaians have bad perception about the industry is claims. Growth in premium generation will make insurance companies have enough liquidity to pay claims as quickly as possible. The total claim amount paid by all the insurers at the end of 2018 was Ghc358,660,408.

Considering claim expenditure, Enterprise insurance is the one who took the lead in claim payments. The insurer paid Ghc53,535,951 to settle claim. This was followed by SIC Insurance (32,459,884), Vanguard Assurance (Ghc28,101,941) and Hollard Insurance (Ghc27,682,082). The remaining 23 general insurers spent GHc141,779,858. GN Insurance had the least amount of claim payment, Ghc269,901.

Conclusion

The assessment of the insurance sector reveals the structure of competition within the insurer’s operating environment and competitive position in the industry. This reveals the relationship in premium generation, claim payments and market share.

Writer: Gideon Sarfo

Email Address: sarfo.gideon03@yahoo.com/ gsinsuranceconsult@gmail.com

Disclaimer: "The views expressed on this site are those of the contributors or columnists, and do not necessarily reflect insureghana's position. insureghana.com will not be responsible or liable for any inaccurate or incorrect statements in the contributions or columns here."

Share On Social Media

Other Posts

What is Cyber-Insurance? What You Need To Know

15 Best AI Tools Every Insurance Agent Should Use | AI for Insurance Agents

Edward Mensah, Wood and Associates Insurance Brokers Named Overall Best Insurance Broker 2024

CSA has sounded the alarm about insider threats in the insurance sector

Ghana’s insurance industry intensifies public education to build trust and boost coverage

Impact Life Insurance Company Limited launches “ABRABOPA” product in Kumasi

Insurance companies in Ghana: ranking per 2024 insurance revenue

Ghana’s 24Hour programme: Who’s leading, how it’s measured, and when it starts

Five (5) Reasons Why You Need a Homeowners Insurance Policy

Bringing insurance education to classrooms in Ghana

InsureTech

Technology