Felin Insurance And Enterprise Life Introduces Unique Life Policy

15 November, 2018

Policy pays GHc20,000.00 each to two beneficiaries

FELIN Insurance Brokers Ltd, in collaboration with Enterprise Life, has introduced a unique

life insurance policy that defies age limits of the insured. The Ultimate Group Funeral Policy provides. cover for persons of all ages in groups, associations or social clubs, with one policyholder able to insure the entire nuclear family plus parents and/or in-laws.

The policy, which is the first of its kind, entitles holders to varying sums of benefits from GH¢5,000 to GH¢20,000.

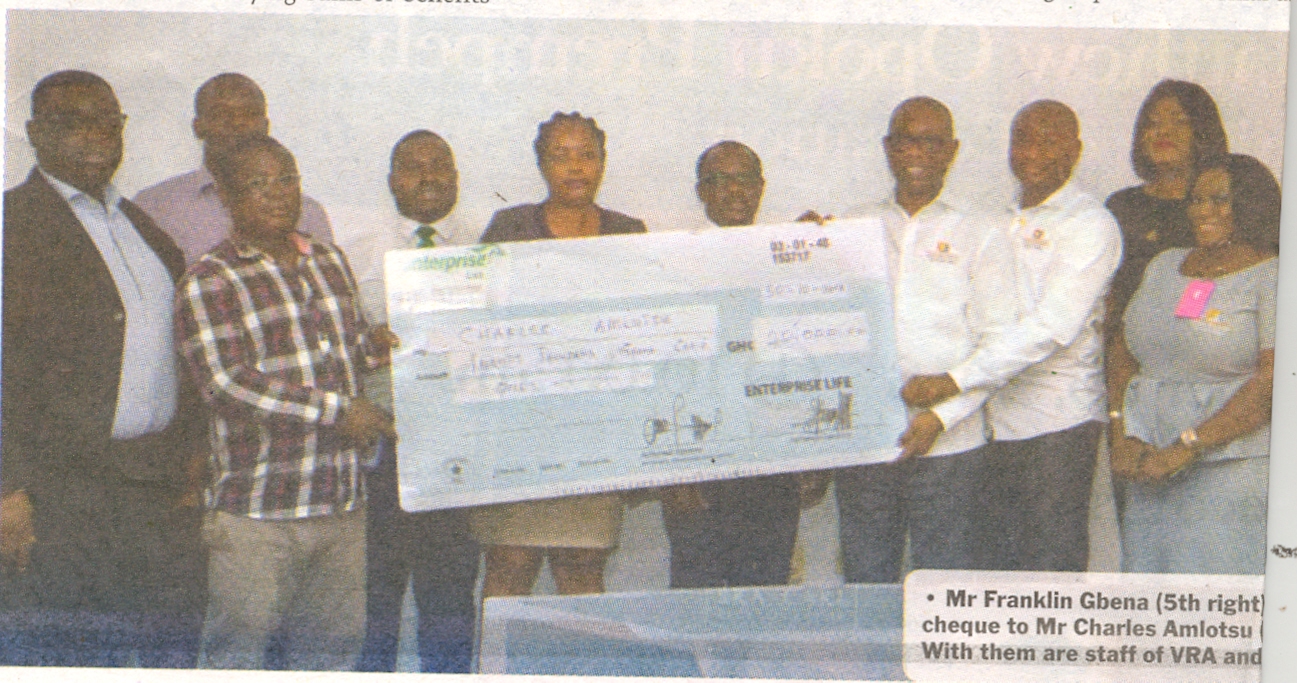

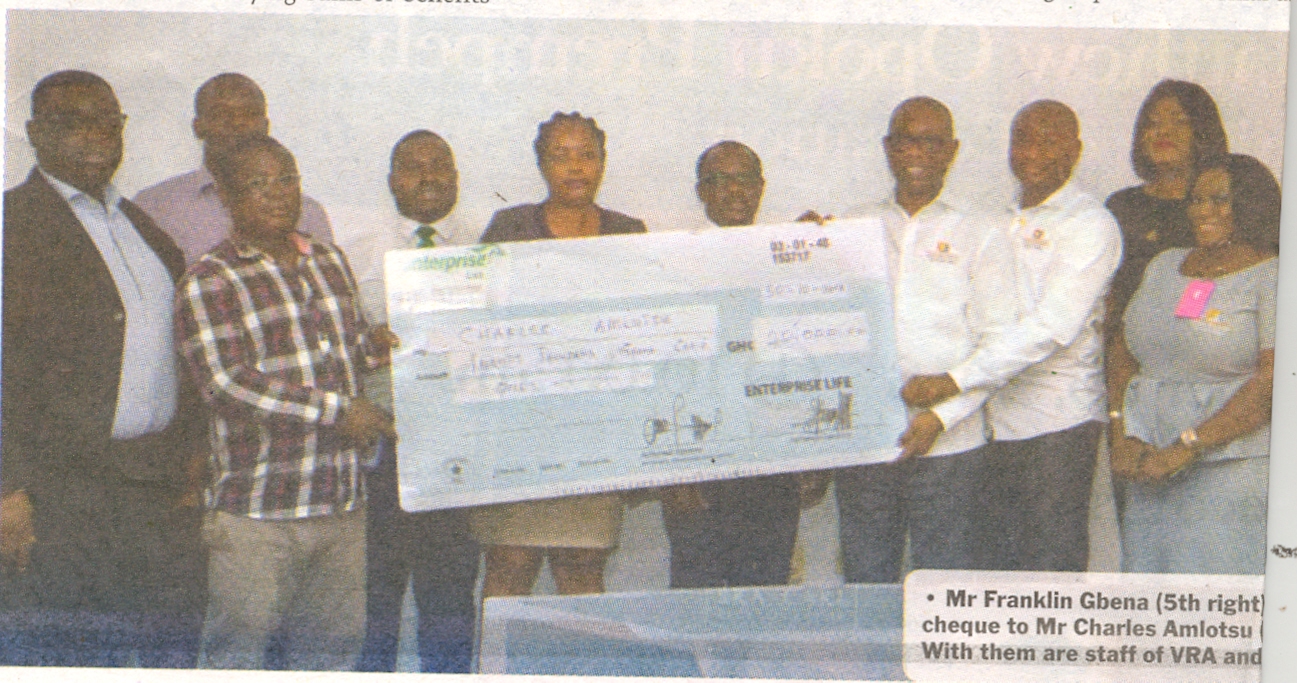

The Chief Executive Officer of Felin Insurance Brokers, Mr Franklin Gbena, who disclosed this during claims payment to a beneficiary in Tema, said the policy also neutralised certain prerequisites of traditional life insurance policies, such as medical underwriting requirements.

He said not only did the policy offer competitive premiums, but it could be tailored to the needs of groups or associations, the main targets of the policy. In addition to the nuclear family, the primary cover under the policy, the holder could opt to insure up to four parents, meaning the parents of spouses could be covered as well,

he added.

Groups

Mr Gbena explained that for the flexibilities and competitiveness it provided, the cover was offered to groups with a minimum membership of 30 people. It was, therefore, suitable for groups, unions, associations, clubs and other identifiable groups in the formal and informal sectors to take funeral expense burdens off their heads.

The CEO of Felin Insurance Brokers said the Ultimate Group Funeral Policy could be taken as a complement to the Group Life Insurance which was mandatory for corporate

institutions against their employees over accidental permanent disability.

Claim

So far, two staff of the Volta River Authority (VRA) and the Northern Electricity Development Company (NEDCo) have been

paid GH¢20,000 benefit each against the passing of their parents. Mr Gbena called on groups and welfare associations to contact Felin or Enterprise to sign on "to the policy to the benefit of all.

About Felin, Enterprise Life

Felin started operations in 1995 as an agent of the then M~ropolitan Insurance, now Hollard, and later managed the company's offices in Akosombo and Techiman, where it sold a lot of life policies and managed motor

fleet of companies. It later acquired a licence and started operations as a broker in 2013 and now acts as an interface between clients and their insurance companies. Enterprise Life operates as a specialist life insurance company, incorporated in 2000 to provide affordable and innovative life

assurance products to. meet the needs of policyholders and the public.

The company distributes life insurance through a diversified distribution channel comprising agencies, brokers and bank channels. Enterprise Life now has representation in all 10 regions in the country.

By Samuel Doe Ablordeppey, Daily Graphic Accra

Disclaimer: "The views expressed on this site are those of the contributors or columnists, and do not necessarily reflect insureghana's position.

insureghana.com will not be responsible or liable for any inaccurate or incorrect statements in the contributions or columns here."

Other Posts

What is Cyber-Insurance? What You Need To Know

15 Best AI Tools Every Insurance Agent Should Use | AI for Insurance Agents

Edward Mensah, Wood and Associates Insurance Brokers Named Overall Best Insurance Broker 2024

CSA has sounded the alarm about insider threats in the insurance sector

Ghana’s insurance industry intensifies public education to build trust and boost coverage

Impact Life Insurance Company Limited launches “ABRABOPA” product in Kumasi

Insurance companies in Ghana: ranking per 2024 insurance revenue

Ghana’s 24Hour programme: Who’s leading, how it’s measured, and when it starts

Five (5) Reasons Why You Need a Homeowners Insurance Policy

Bringing insurance education to classrooms in Ghana

Business intelligence: the driving force behind insurance sector evolution

Read More

Revolutionising auto insurance: How AI can transform vehicle damage assessment

Read More

Insurance Commission advances digital transformation agenda

Read More

Emerging Trends In Ghanaian Insurance Market An Overview

Read More

What Your Insurance Broker Should Do For You

Read More

7 Signs Of Unethical Insurance Broker

Read More