Car insurance price changes from January 1, 2023

The year 2022 was a tough one for people and businesses around the world.

Ghana struggled with a weakened Cedi and astronomical price increases. Traders adjusted their prices multiple times and banks raised lending rates significantly. The Ghana insurance industry showed goodwill with the market and held back from increasing the cost of insurance protection.

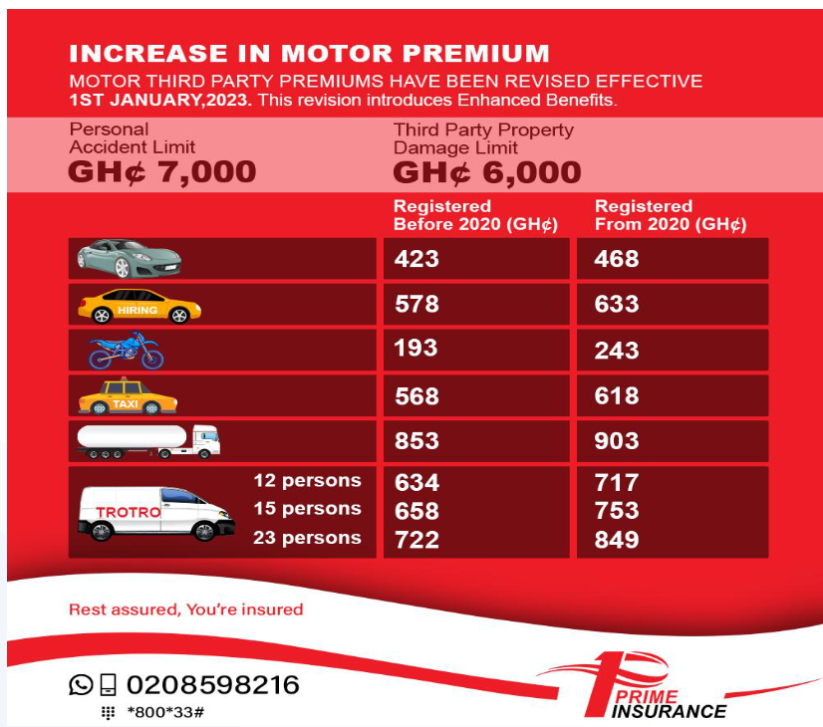

Effective January 1, 2023, the regulator of insurance, the National Insurance Commission (NIC), has implemented new Motor Insurance prices (tariff) which all insurers are mandated to apply.

Among other things, the pricing change is aimed at safeguarding the financial health of car insurance companies so they can continue delivering value to customers.

Before we go into how the new pricing works out, let’s try and understand how car insurance companies managed under the 2022 recessive economic conditions.

Price and premium will be used interchangeably in the write-up to refer to how much you pay to insure your car, and “car” to refer to all vehicles.

How the 2022 economic turbulence impacted car insurance

Insurance claims involve replacement parts, materials, and labour. The cost of parts and materials, all imported, rose sharply during the year. Repair labour costs also surged due to the rising cost of living in the country.

In addition to increasing costs, insurers were confronted with significant losses in the value of investments. Typically, the returns on insurance company investments augment collected premiums for the settlement of claims.

Losses on investments leave insurers in a difficult position with regard to their vital role of helping customers recover quickly from financial loss in case of accidents.

The new car insurance pricing is different in one notable way

The new pricing categorizes vehicles into 2 groups based on the year of registration:

- Group A: vehicles registered before 2020

- Group B: vehicles registered from 2020 onwards

How much you will pay depends on which group your car falls in. For example, if you have a Toyota Corolla saloon car which you use for social and private commuting purposes only, you will pay ¢423 for third-party insurance if the registration year is before 2020.

If you registered in 2020, you will pay ¢468. Until the new pricing came into effect on January 1, all private cars used for social and private commuting purposed paid ¢327.

You can CLICK HERE to check how much you will be paying for your car within 1 minute.

What the new prices mean for your pocket

You will be paying up to 43% more for third-party car insurance than you did in 2022. Given that the third-party price is a factor in determining comprehensive insurance premiums, you will observe an increase in your comprehensive insurance cost as well.

Disclaimer: "The views expressed on this site are those of the contributors or columnists, and do not necessarily reflect insureghana's position. insureghana.com will not be responsible or liable for any inaccurate or incorrect statements in the contributions or columns here."

Share On Social Media

Other Posts

What is Cyber-Insurance? What You Need To Know

15 Best AI Tools Every Insurance Agent Should Use | AI for Insurance Agents

Edward Mensah, Wood and Associates Insurance Brokers Named Overall Best Insurance Broker 2024

CSA has sounded the alarm about insider threats in the insurance sector

Ghana’s insurance industry intensifies public education to build trust and boost coverage

Impact Life Insurance Company Limited launches “ABRABOPA” product in Kumasi

Insurance companies in Ghana: ranking per 2024 insurance revenue

Ghana’s 24Hour programme: Who’s leading, how it’s measured, and when it starts

Five (5) Reasons Why You Need a Homeowners Insurance Policy

Bringing insurance education to classrooms in Ghana

InsureTech

Technology